All Categories

Featured

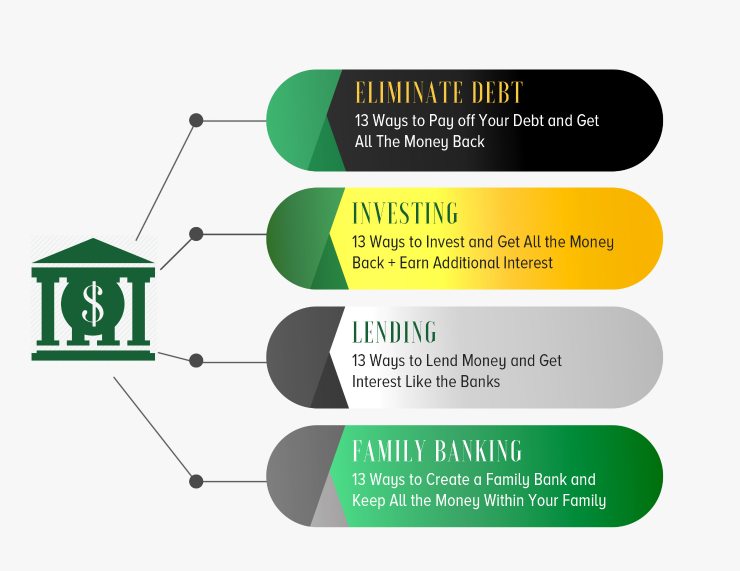

Entire life insurance coverage plans are non-correlated possessions - Leverage life insurance. This is why they function so well as the economic foundation of Infinite Financial. No matter of what occurs on the market (supply, realty, or otherwise), your insurance coverage keeps its worth. A lot of people are missing this crucial volatility buffer that helps secure and expand wide range, rather dividing their cash right into 2 buckets: bank accounts and financial investments.

Market-based investments expand wealth much faster but are subjected to market fluctuations, making them naturally risky. Entire life insurance is that third pail. Whole life for Infinite Banking. Generational wealth with Infinite Banking.

Latest Posts

What are the risks of using Infinite Banking In Life Insurance?

What is the long-term impact of Tax-free Income With Infinite Banking on my financial plan?

How can Self-banking System reduce my reliance on banks?

More

Latest Posts

What are the risks of using Infinite Banking In Life Insurance?

What is the long-term impact of Tax-free Income With Infinite Banking on my financial plan?

How can Self-banking System reduce my reliance on banks?